New Delhi

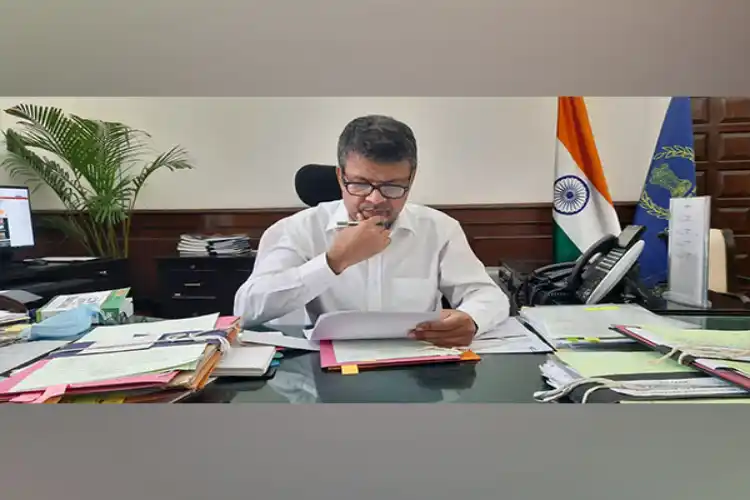

The imposition of 30 per cent tax on proceeds of digital assets, as announced in the Union Budget 2022-23, will lead to huge tax collections as the turnover of the top 10 crypto exchanges in the country is around Rs 1 lakh crore, said JB Mohapatra, Chairman, Central Board of Direct Taxes (CBDT).

Mohapatra said there are around 40 crypto exchanges functioning in India out of these 10 are significant transactions. Their turnover is between Rs 34,000 crore to Rs 1 lakh crore.

“If we charge TDS at 1 per cent on these turnovers then you can estimate the collection through TDS income tax department will get. The proposal to tax 30 per cent on the individual transactions from April 1, 2022 government will generate huge tax collection, but it will be very difficult to say at the moment what will the exact tax collection by taxing the transfer of digital assets," he said.

The CBDT Chairman said, "During our pilot project on crypto we found that they are operating on four models. People are trading in crypto but they are not filing it in their income tax returns. Those crypto traders filing their income tax returns have no indication of crypto trading. The third model, we found that there are details of crypto trading but their estimates of stock sale and purchase or cryptos are wrong. The fourth model shows the details of crypto profits in their income tax return but they show it as income from other sources, income from capital gains, or income from the business. In suspicious cases, income tax returns were not filed. This is very problematic for us.

Mohapatra said that tracking and tracing these crypto investors is very difficult. The TDS provision will now help in tracking and tracing the people who are in this business and making profits but are not filing it in their income tax returns. Other than tracing through TDS they can be tracked through reporting entities.

He further added that the real identity of investors is problematic. "Those who don't file their income tax return and are doing heavy transactions in their accounts are suspicious for us. Our target is to find out the truth behind it, whether he is trading for himself, is it proxy, or is it benami," he said.

The new legislation will help the income tax department find out the real investors behind the trades which have been concluded.

Clarifying the definition of digital assets Mohapatra said that the definition of digital assets is given under section 247A. Any information or code or number or token generated through cryptographic means or otherwise, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value stored or traded electronically are digital assets. A non-fungible token (NFT) or any other token of similar nature is also a digital asset.

CBDT Chairman clarified that the taxability of the crypto-currency is certain for this financial year too. Crypto investors should know that transactions done before April 2022 will not be tax-free.