New Delhi

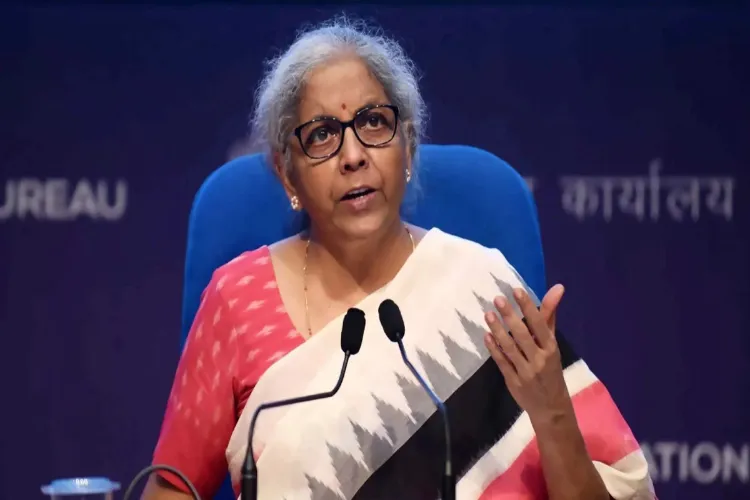

Finance Minister Nirmala Sitharaman on Tuesday said that rapid digitalisation of the global economy and the emergence of new financial products require countries to strengthen cooperation and ensure timely exchange of tax-related information while upholding fairness and public trust in tax systems.

Addressing the 18th Global Forum Plenary Meeting, the minister stressed that confidentiality and cybersecurity must remain a priority, even as jurisdictions work together to address challenges arising from digital transactions, complex beneficial-ownership structures and evolving financial instruments.

“These are not challenges that any one country can address alone. They demand coordination, trust and timely exchange of relevant information,” Sitharaman said.

The Global Forum on Transparency and Exchange of Information for Tax Purposes, consisting of 170 jurisdictions, monitors and peer-reviews implementation of international standards on transparency and information sharing.

Sitharaman said that transparency becomes “effective and fair” only when guided by clear rules, mutual respect and shared objectives. She emphasised that the Forum’s role in reviewing implementation, refining standards and supporting member countries remains “critical”.

As digitalisation increases the volume and complexity of financial data, Sitharaman said that jurisdictions should not only exchange information but also ensure it leads to “measurable outcomes”. She encouraged the use of technology — including artificial intelligence — to analyse data efficiently, while underlining the need for oversight.

“Innovation must always walk hand in hand with accountability. It is that balance which gives systems strength and credibility,” she said.

The minister noted that India has seen stronger voluntary tax compliance over the last decade due to greater fairness and predictability and is increasingly integrating exchanged information into broader compliance and risk-analysis systems.

ALSO READ: Moulana Dr Mohamed Imran Rashadi: Peacebuilder of Bengaluru

“We may come from different jurisdictions and traditions, but we are united by the shared purpose to ensure that lawful economic activity is encouraged, and evasion is discouraged,” she added.