New Delhi

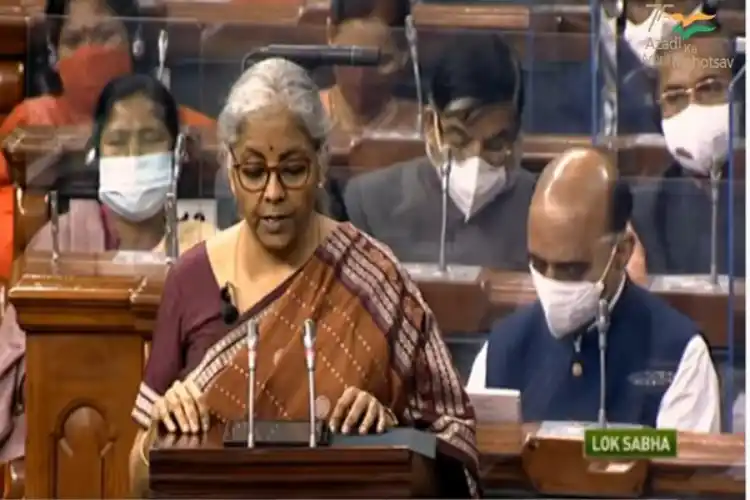

The Union budget for 2022-23, presented by Finance Minister Nirmala Sitharaman on Tuesday lays down the foundation for changing the face of India by the time the country celebrates 100 years of its existence as a modern state while introducing infrastructure for digitalization and tax structure for cryptocurrency.

There is no change in income tax slabs in the budget but taxpayers can now file an updated return within 2 years from the relevant assessment year.

The budget which aims to boost growth amid continued disruption from Covid-19 and rising inflation has stressed infrastructure spending.

The long-term vision of the budget is aimed at continuing the push for connectivity and infrastructure under the flagship scheme PM Gatishakti Master plan that will be in place for the next five years called Amtit Kal. Under this scheme, road connectivity, Railways’ rejuvenation, and connectivity in border and hilly areas will be undertaken in a massive way.

‘PM Gati Shakti’ is projected to lead 7 engines of growth – roads, railways, ports, mass transport, waterways, and logistics infra.

Sitharaman said the PM Gati Shakti Master Plan for Expressways will be formulated in 2022-23. The national highways network will be expanded by 25,000 km in the current financial year and Rs 20,000 crores will be mobilized to complement public resources.

There are also plans for Metro systems at an appropriate scale as part of mass transport.

The finance minister announced a 35.4 per cent boost in the outlay of capital expenditure from Rs 5.54 lakh crore in the current year to Rs 7.50 lakh crore in 2022-23.

Income from the transfer of any virtual digital asset shall be taxed at the rate of 30%. Besides, the corporate surcharge has been reduced from 12% to 7%.

Surcharge on long-term capital gains will be capped at 15%, Sitharaman said.

The Finance Minister also announced that the Reserve Bank of India will issue a digital rupee in the next financial year.

Tax deduction limit to be reduced for central government employees from 18 percent to 15 percent in their contribution to NPAs, said the finance minister.

Both Centre and state government employees' tax deduction limit to be increased from 10 percent to 14 percent to help the social security benefits of state government employees and bring them at par with the Central government employees.

In a major push for the Make in India exercise, the Budget also hiked the share of the domestic defence industry in the modernisation of armed forces with 68 per cent capital funds earmarked for procurement from local firms.

The Budget also set a target to reduce fiscal deficit to 6.4 per cent of GDP in 2022-23 from the estimated 6.9 per cent in the current financial year.

In her budget speech, Sitharaman announced that disinvestment receipts have been pegged at Rs 65,000 crore next year. She also said that estimates for the current year have been cut to Rs 78,000 crore from Rs 1.75 lakh crore.