Hong Kong

Asian shares mostly rose Tuesday, after stocks on Wall Street closed broadly lower as the White House stepped up pressure on major trading partners to make deals before punishing tariffs imposed by the US take effect.

Japan's Nikkei 225 added 0.3% to 39,724.90 while South Korea's Kospi surged 1.8% to 3,115.38.

Hong Kong's Hang Seng index climbed 0.7% to 24,047.40 while the Shanghai Composite gained 0.7% to 3,497.40. Australia's S&P/ASX 200 edged 0.1% lower to 8,590.70.

“Asian markets treated today's fresh round of maybe talks, maybe not' as more background noise than breaking news,” Stephen Innes, managing partner at SPI Asset Management, wrote in a commentary. “Markets didn't lurch because they've seen this show before. Tariff hike, rhetoric spikes, and then — like clockwork — comes the sudden pivot: We're still open to talks.'”

On Wall Street on Monday, the S&P 500 fell 0.8% for its biggest loss since mid-June. The benchmark index remains near its all-time high set last week.

The Dow Jones Industrial Average gave back 0.9% while the Nasdaq composite also finished 0.9% lower, not too far from its own record high.

The losses were widespread. Decliners outnumbered gainers by nearly 4 to 1 on the New York Stock Exchange.

Tesla tumbled 6.8% for the biggest drop among S&P 500 stocks as the feud between CEO Elon Musk and US President Donald Trump reignited over the weekend. Musk, once a top donor and ally of Trump, said he would form a third political party in protest over the Republican spending bill that passed last week.

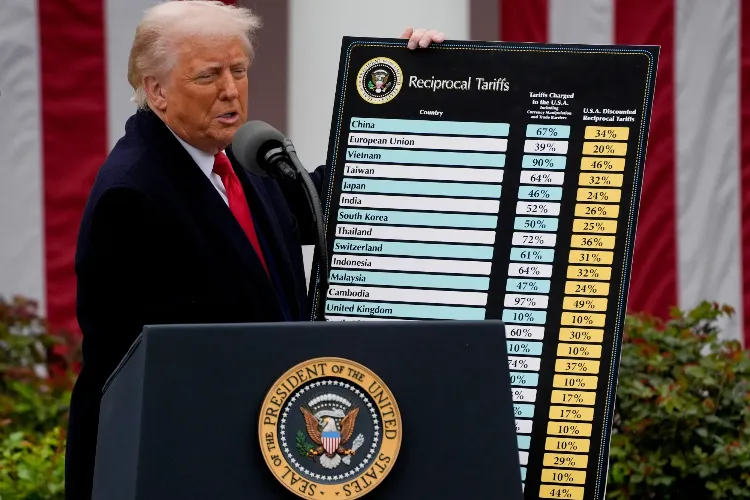

The selling in US trading accelerated after the Trump administration released letters informing Japan and South Korea that their goods will be taxed at 25% starting on Aug 1, citing persistent trade imbalances with the two crucial US allies in Asia.

Trump also announced new tariff rates on Malaysia, Kazakhstan, South Africa, Laos and Myanmar.

Just before hefty US tariffs on goods imported from nearly every country around the globe were to take effect in April, Trump postponed the levies for 90 days in hopes that foreign governments would be more willing to strike new trade deals. That 90-day negotiating period was set to expire before Wednesday.

In a post on his social media platform late Sunday, Trump also said any country that aligns itself with what he termed “the Anti-American policies of BRICS” would be levied an added 10% tariff. BRICS member nations include Brazil, Russia, India, China, South Africa, Egypt, United Arab Emirates, Ethiopia, Indonesia, and Iran. Saudi Arabia has also been invited to join.

This latest phase in the trade war heightens the threat of potentially more severe tariffs hanging over the global economy. Higher taxes on imported goods could hinder economic growth, if not increase recession risks.

Japan's Mizuho Bank Ltd, in a commentary, said the three-week extension in the tariff deadline “is a distraction from festering, and possibly widening, tariff risks.”

In other dealings on Tuesday, benchmark US crude oil lost 18 cents to $67.75 per barrel. Brent crude, the international standard, gave up 14 cents to $69.44.

ALSO READ: Farah Shaikh is behind lifting of unspoken ban on women's entry into mosques

The dollar was trading at 146.07 to the Japanese yen, slightly up from 146.01 yen. The euro rose to $1.1737 from $1.1714.