New Delhi

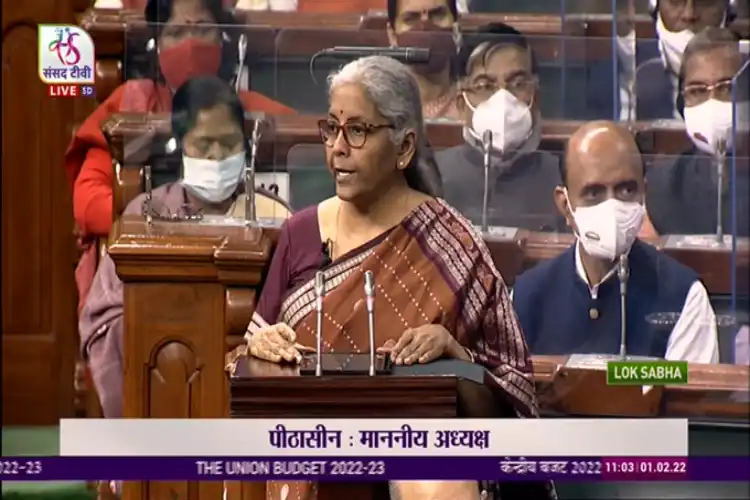

The Union budget for 2022-23, presented by Finance Minister Nirmala Sitharaman on Tuesday lays down the foundation for changing the face of India by the time the country celebrates 100 years of its existence as a modern state while introducing infrastructure for digitalization and tax structure for cryptocurrency.

While presenting the budget to both the Houses of Parliament, Finance Minister Nirmala Sitharam said there will be no change in the income tax slabs while it gives a number of options to those having filed their tax returns inaccurately. With the spirit of encouraging tax compliance, the budget introduced a two-year term for the taxpayers to revise their estimated tax and make payments wirthout inviting the wrath of the authorities.

During her budget speech, Sithraman announced that the increased compliance of the tax-paying regime was evident as in January India had seen the highest collection of GST (Goods and services taxes) of Rs 1.38 lakh crores.

Sithraman’s budget proposes India’s first digital University and income tax of 30 percent on30% tax on Virtual Digital Assets.

However, the long-term vision of the budget is aimed at continuing the push for connectivity and infrastructure under the flagship scheme PM Gatishakti Master plan that will be in place for the next five years called Amtit Kal. Under this scheme, road connectivity, Railways’ rejuvenation, and connectivity in border and hilly areas will be undertaken in a massive way.

The India post office will get a makeover with some of the key post offices also functioning as banks.

The pro-people schemes like providing relief to farmers, free food to the poor, and houses to the homeless will continue to be implemented with more allocations.

Introducing parity between the State and the central government employees, the budget introduces provision of increased contribution from the government from 10 to 14 percent – for the provident fund.

Likewise, the surcharge on Co-operatives will be reduced from 12% to 7% and bringing it at par with the companies. This step is aimed at helping farmers and other cooperatives.

Atmanirbhar Bharat finds repeated mention in the budget document – from defense equipment to introducing the one railway station one product concept to give a push to “vocal for Local” scheme to help small artisans and traditional crafts.

On social front, while all the schemes for women, children, health and farmers will continue with more fund infusion, the budget takes into account the increased prevalance of mental health issued in the post pandemic period.

The experts said the continuation of the tax rebates to new businesses and startups will give a fillip to the economy and the growth in the manufacturing sector and small and medium scale industries combined with infrastructure push will give a boost to employment generation.