Sushma Ramachandran

Sushma Ramachandran

The annual budget of the government used to be considered a mysterious document meant to unveil many surprises, both pleasant and unpleasant, on the day of its presentation. Fortunately, this view of the budget has changed gradually in recent years as economic policymaking has become more transparent and also carried out throughout the year rather than confined to this one event. For the last two years, however, the grip of the pandemic has meant that the economy has been severely strained just as in most other countries around the world. India, like many other developed and developing countries, is seeking to revive economic growth as the Carona virus recedes and normal industrial and commercial operations begin once again. This budget thus has special significance as it needs to give an impetus to the growth process which had contracted in 2020-21.

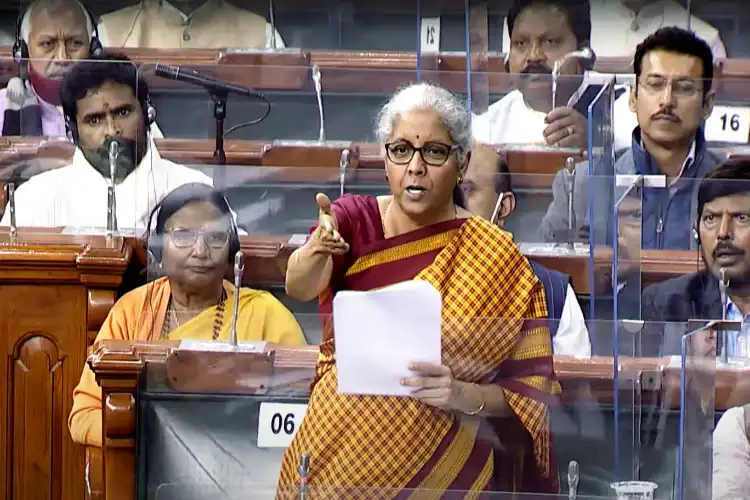

Finance Minister Nirmala Sitharaman has largely met expectations by presenting a budget for 2022-23 that has a single-minded focus on growth. It has raised public investment in infrastructure higher than ever before. The key highlight this year is a 35.4 percent increase in capital expenditure that is expected to kick start a virtuous cycle of investments. The rise in government expenditure comes in the wake of widespread clamour over the need to raise public investment in a bid to give a boost to the economy as well as create more jobs.

Capital expenditure is being raised from Rs. 5.54 lakh crore to Rs. 7.5 lakh crore in 2022-23 bringing it to 2.9 percent of GDP. The fiscal deficit has been kept at 6.4 percent as against 6.9 percent in the current fiscal. An ambitious long-term estimate of 60 lakh jobs has been pegged for the next five years.

The budget proposals appear to be part of a long-term vision this time rather than looking merely at the short or medium term. The infrastructure investment plans have been organized around what has been described as the PM Gatishakti scheme to transform the transport sector in multiple ways. The seven engines outlined for this programme are road, railways, airports, ports, mass urban transport, waterways, and logistics infrastructure. These projects are linked to those identified in the National Infrastructure Pipeline outlined last year. In other words, the aim is to build permanent sustainable assets in the long run.

As for the near term, the budget proposals have sought to meet the crisis faced by the battered micro and medium-small enterprises segment by expanding the emergency credit line guarantee (ECLGS) by Rs. 50000 crores specifically for the hospitality sector. More needs to be done, however, for the contact-intensive segment of the economy that has faced repeated closures owing to movement curbs during the pandemic.

Another disappointment has been the failure to provide some form of direct benefit transfer to those at the bottom of the pyramid both in urban and rural areas.

This would have provided immediate relief for those facing the brunt of the impact of the economic collapse in 2020-21. There are differing views on whether it would raise consumption, but it is cannot be denied that it would have provided much relief. Existing welfare schemes such as free food and the PM Kisan Yojana are laudable but more was needed to ease the pain facing the large informal sector of the economy.

On the plus side, the decision to introduce the production-linked incentive scheme for the solar power sector will go a long way in boosting renewable energy capacity. It has already expanded faster than anticipated over the past few years. The other scheme likely to have long-term ramifications is the decision to open up the Defence research and development for industry, start-ups, and academia. Private industry will now be encouraged to take up the design and development of military platforms and equipment in collaboration with DRDO and other similar organizations.

A much-needed impetus has also been given to digitizing the economy. The big news is the launch of the digital rupee as well as implicit recognition of crypto-currency by taxing all transactions involving virtual digital assets. The 30 percent taxation is in the fitness of things, given that the crypto trade is largely speculative. And the one percent tax deduction at source ensures that such transactions will now come into the formal financial sector which was the need of the hour.

Other initiatives likely to prove helpful at the ground level include the launch of digital banking with 75 digital banking along with the promotion of payment platforms. It has been seen that greater digitization has proved supportive to vulnerable sections intimidated by the physical infrastructure of the banking network.

As for public sector disinvestment, it now seems to be on a low key though Finance Ministry officials have assured that the process continues to be underway though it was disrupted by the pandemic. The outlay for the next fiscal has been kept at a modest Rs. 65000 crore compared to Rs.1.75 lakh crore in 2021-22. This is a bid to dampen expectations given that over the past few years, it has not been possible to meet earlier more ambitious disinvestment targets. Last year, however, an entire pipeline of public sector companies meant for privatization was unveiled including two banks. The first major outcome was the sale of Air India which has been a significant milestone.

Finance Minister Sitharaman indicated right at the outset of the budget proposals that the focus was going to be on economic development over the next 25 years, from India at 75 to India at 100 years since independence. However, there is a need to push growth in the near term as well and this is sought to be achieved by the unprecedented increase in public investment in the next fiscal.

Also Read: 2021 has made India a Unicorn nation

The current year, 2021-22, is likely to end on a positive note with growth buoyant at 9.2 percent. Even so, it comes on a low base as the economy contracted by 7.3 percent in the previous year. The budget aims at maintaining the current momentum so that the pandemic’s adverse impact is reversed in the next fiscal, 2022-23. However, infrastructure projects need to get on track in a hurry. Only then will the long-term vision be realized as speedy implementation is critical for economic revival.