Mumbai

The Reserve Bank of India (RBI) on Thursday kept key policy rates unchanged and maintained 'accommodative' stance in order to give priority to GDP growth.

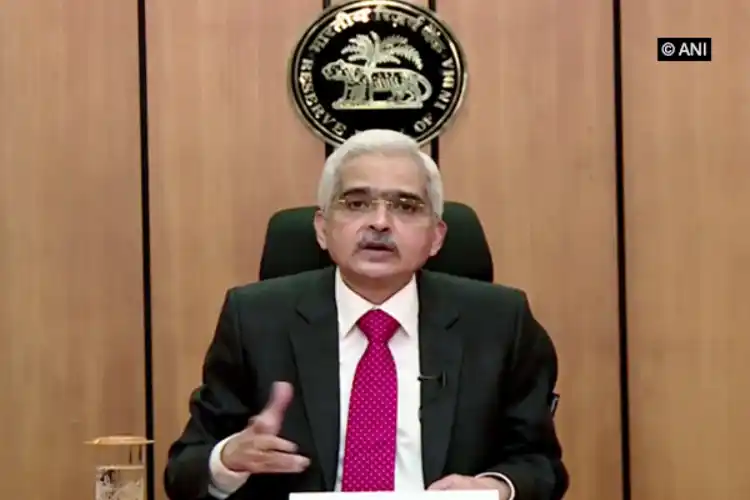

"The Monetary Policy Committee (MPC) met on 8th, 9th and 10th February 2022 and based on an assessment of the current macroeconomic situation and the outlook, it voted unanimously to keep the policy repo rate unchanged at 4 per cent," RBI Governor Shaktikanta Das said in the first monetary policy statement after the Union Budget 2022-23.

The repo rate is the interest rate at which the RBI lends short-term funds to banks.

The reverse repo rate, the interest rate at which the RBI borrows from banks, remains unchanged at 3.35 per cent.

This is the 10th consecutive policy review when the RBI has decided to maintain a status quo on key policy rates. The central bank has not changed repo and reverse repo rates since May 2020.

The marginal standing facility (MSF) rate and the Bank Rate remain unchanged at 4.25 per cent.

Das said the MPC decided by a majority of 5 to 1 to continue with the "accommodative stance" as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

The six-member Monetary Policy Committee (MPC) headed by the RBI Governor meets once every two months to review monetary policy.

Das said the committee has pegged the GDP growth for the financial year 2022-23 at 7.8 per cent.

"Overall, there is some loss of the momentum of near-term growth while global factors are turning adverse. Looking ahead, domestic growth drivers are gradually improving. Considering all these factors, real GDP growth is projected at 7.8 per cent for 2022-23 with Q1:2022-23 at 17.2 per cent; Q2 at 7.0 per cent; Q3 at 4.3 per cent; and Q4 at 4.5 per cent," he said.

The GDP growth projection by the RBI for the financial year 2022-23 is substantially lower from the 8 to 8.5 per cent economic expansion projected for the year in the Economic Survey tabled in Parliament by Finance Minister Nirmala Sitharaman on January 31, 2022.

As per the first advance estimates of national income released by the National Statistical Office (NSO) on January 7, 2022, India's real gross domestic product (GDP) growth is likely to be 9.2 per cent for 2021-22.

Das said the real GDP growth at 9.2 per cent for 2021-22 takes it modestly above the level of GDP in 2019-20. Private consumption, the mainstay of domestic demand, continues to trail its pre-pandemic level.

The persistent increase in international commodity prices, surge in the volatility of global financial markets and global supply bottlenecks can exacerbate risks to the outlook.

"Going forward, government's thrust on capital expenditure and exports are expected to enhance productive capacity and strengthen aggregate demand. This would also crowd in private investment. The conducive financial conditions engendered by the RBI's policy actions will provide impetus to investment activity," the RBI Governor said.

Das said the MPC flagged the potential downside risks to economic activity from the highly contagious Omicron variant

"Reassuringly, the symptoms have remained relatively mild and the pace of infections is moderating as quickly as it surged. There is, however, some loss of momentum in economic activity as reflected in high frequency indicators such as purchasing managers' indices for both manufacturing and services, finished steel consumption and sales of tractors, two-wheelers and passenger vehicles. The demand for contact-intensive services is still muted," he said.

"Going forward, positive impulses for quickening the pace of recovery emanate from buoyant Rabi prospects, robust export demand, accommodative monetary and liquidity conditions, improving credit offtake, and the continued push on capital expenditure and infrastructure in the Union Budget 2022-23," said the RBI Governor.

Das noted that the economic condition remains highly uncertain due to the lingering COVID-19 pandemic and the threats from the new variants.

"We are living in a world of Knightian uncertainty in the absence of determinate knowledge about the next mutation of COVID-19. The ability to forecast the future course of the economy is so contingent on the evolution of the virus that one prognosis is as good or as bad as the other and as ephemeral," he said.