Bhopal

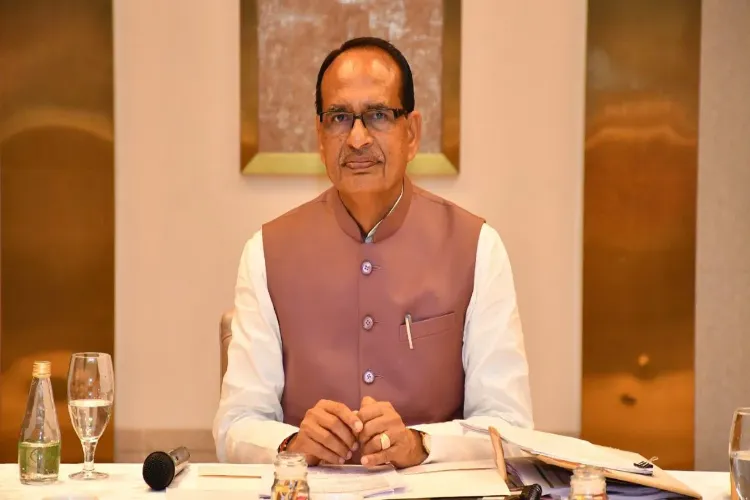

Union Agriculture Minister Shivraj Singh Chouhan on Saturday hailed the Goods and Services Tax (GST) reforms, emphasising that the Centre is aiming to reduce the cost of production in agriculture and increase overall output, which would benefit farmers directly.

The Union Minister stated that the National Democratic Alliance (NDA) government has been continuously working to improve the lives of the common people through GST reforms, particularly in the agricultural sector.

Addressing the press conferences in Bhopal, Chouhan said, "Our aim is to reduce the cost of production in farming and increase production...The farmers of the country will get a big benefit from the GST reforms."

"The NDA government, under the leadership of Prime Minister Narendra Modi, is continually making efforts to improve the lives of the common man...From the ramparts of the Red Fort, PM Modi told the country that next-generation reforms will be brought in GST and those reforms have brought great relief to the people," Chouhan further added.

The Union Minister also underlined the role of women's self-help groups (SHGs) in strengthening rural economies. "Women self-help groups are working on a large scale in handicrafts, handmade goods, leather goods, milk and milk products, which have made many sisters Lakhpati Didi. Their lives will also improve," Chouhan said.

On Wednesday, the 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

The 5 per cent slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agriculture equipment; handicrafts and small industries; also medical equipment and diagnostic kits.

The 18 per cent slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18 per cent rate applies to all auto parts.

Additionally, there is a 40 per cent slab for luxury and sin goods, including tobacco and pan Masala, products such as cigarettes, bidis, and aerated sugary beverages, as well as luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

READ MORE: Golam Faruk and Geeti Hakim are transforming lives with love and compnassion

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance; also, certain services related to education and healthcare are GST-exempt.