Gurugram

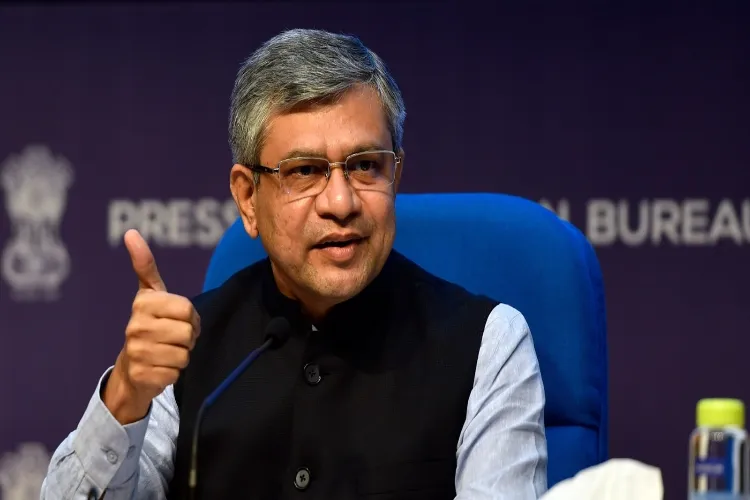

Union Minister Ashwini Vaishnaw on Thursday praised the Goods and Services Tax (GST) reforms, terming them a major step that will help every family in the country.

Vaishnaw said that the new GST tax slabs will be effective from the first day of Navaratri, and rates have been reduced for almost every item which is used in the lives of middle-class families.

"From the ramparts of the Red Fort, the PM had said that before Diwali, all middle-class families will receive a big gift and yesterday, the Union Finance Minister announced a major GST reform. This will come into effect from the first day of Navratri. GST rates have been slashed for almost everything that is used in the lives of middle-class families. I would like to thank Prime Minister Narendra Modi for this big step, major reform which will help each and every family in the country," Ashwini Vaishnaw said.

Meanwhile, Industry has also welcome the rationalisation of GST rates. Amul India MD Jayen Mehta said the step would lead to sustained growth in the incomes and livelihood of millions of milk producers.

"On behalf of the 36 lakh farmer families affiliated with the Amul Dairy Cooperative Movement in Gujarat and more than 10 crore families associated with the dairy industry of the country, we are thankful to PM Modi and FM Nirmala Sitharaman for this landmark decision of reduction in GST rates of most food items and particularly the dairy product categories. More than 30 different dairy and food product categories that we are associated with have seen a significant decline in the GST rates. We are confident that this would lead to increased consumption of all these important food items of the dairy product category and this will lead to a sustained growth in the incomes and livelihood of millions of milk producers associated with it," Jayen Mehta said.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

5% slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agricultural equipment like drip irrigation systems, sprinklers, bio-pesticides, micronutrients, soil preparation machines, harvesting tools, tractors, and tractor tires; handicrafts and small industries like sewing machines and their parts and health and wellness like medical equipment and diagnostic kits.

While the 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

Additionally, there is also a 40% slab for luxury and sin goods, including tobacco and pan Masala, products like cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

READ MORE: Halima Khatun fights poverty through women's rights in Sundarbans

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance, no GST on health and life insurance premiums and education and healthcare, like certain services related to education and healthcare are GST-exempt.