Sushma Ramachandran

Sushma Ramachandran

Leading global investment agency, Blackrock, has created ripples with its latest assessment that the top geopolitical risk facing markets worldwide is the “strategic competition between the U.S. and China. It rates the issue as a higher risk than the potential escalation of either the Ukraine-Russia, or Israel-Hamas conflicts.

The focus on the relationship between the two major economies comes at a time when there is concern over the possible widening of the conflagration in West Asia. Fears over the expansion of tensions between the U.S. and China have been put on the backburner by most analysts, given the immediate crisis being faced by the war between Israel and Hamas. Yet the geopolitical risk dashboard of the Blackrock Investment Institute has placed these ties at an attention score of 1.5. This is in sharp contrast to the score of -0.65 for conflict escalation in West Asia and 0.37 for a war between Russia and the North Atlantic Treaty Organisation (NATO).

Outlining their reasons, Blackrock analysts maintain the two countries have entered into a “long-run competitive posture” and stress that any thaw in the relationship would be fragile. On the Chinese side, they refer to its actions in the South China Sea and the pressure put on Taiwan. Similarly, they note that increased military and economic support was being provided by the U.S. to Taiwan. While there may not be any military action, they considered the risk to be increasing.

The investment agency’s apprehensions highlight the fact that the two biggest economies are increasingly taking opposing stances on recent geopolitical developments. First, in the case of the Ukraine war, the U.S. has come out strongly against Russia’s invasion and it has been joined by the U.K. and the European Union. In contrast, China has stood by Russia and extended its full support including abstaining from U.N. resolutions condemning the military action in Ukraine. India has also been abstaining from these resolutions and sought to take a neutral stance. But it has also reached out to provide humanitarian aid to Ukraine while Prime Minister Narendra Modi said this is not an era for war during a meeting with Russian President Vladimir Putin.

Second, China has drawn closer to Iran, a country that has been antagonistic to the U.S. for many decades. It is Iran which is reported to have given full support to Hamas for launching the war against Israel. China is also reported to be trying to position itself as a peacemaker in the conflict. Significantly, it has not used the term Hamas in its public statements but has termed it as the Israel-Palestine conflict.

Thus on geopolitical issues, the U.S. and China are increasingly seeing themselves on opposing sides. The growing friction between the two countries has thus moved beyond the fractious bilateral relationship. At the same time, it must be recognized that economic and trade ties remain closely intertwined. U.S. goods and services imports from China reached over 563 billion dollars in 2022.

China also remains a major export market for the U.S. with soybeans being one of the leading commodities. According to the U.S.–China Business Council these exports support nearly 1.1 million jobs in the U.S. Large corporates which are part of the S and P500 index are also reported to generate as much as 7.6 percent of their revenue in China.

In other words, the economic relationship would be extremely difficult to untangle in case friction between the two countries grows to a point where military action is taken. The Blackrock assessment does not view such action as a reality in the near term. It does, however, see the risk increasing and points to the Taiwan presidential elections in January 2024 as an important milestone.

The analysis by the investment agency of the potential growth of U.S.-China tensions is undoubtedly a reality check at a time when the world is looking at other arenas of global conflict. It cannot be denied that the growing differences between the two economic giants do not look to ease in either the near or medium term. A flashpoint could be over the growing independence of Taiwan.

From the point of view of India, a toning down of the frictions between the two leading economies would be the best outcome in the near term. Despite the differences with China especially over border issues, this country has a close economic and trade relationship with its northern neighbour. At last count, there were at least 800 Chinese companies based within the country. In addition, many start-ups that have turned into unicorns, have had capital infusion by Chinese firms. Trade ties are also robust though there is a large deficit with imports higher than exports. In this backdrop, a fractious relationship between the two largest economies could create either shortfalls of critical products or cut off a major market for Indian goods.

One of the outcomes of the U.S.-China tensions as well as flagging growth in the Asian economy has been investors’ seeking to shift to other locations like India, Indonesia, or Vietnam. This is known as the China Plus

One policy where firms seek to hedge risks by making fresh investments in these new areas. India has certainly benefited with even tech giant Apple gradually seeking to expand manufacturing facilities in the country. Even so, it would still not be in this country’s long-term interests to have a major conflict involving its northern neighbour.

ALSO READ: Rising oil prices main impact of Ukraine conflict on India

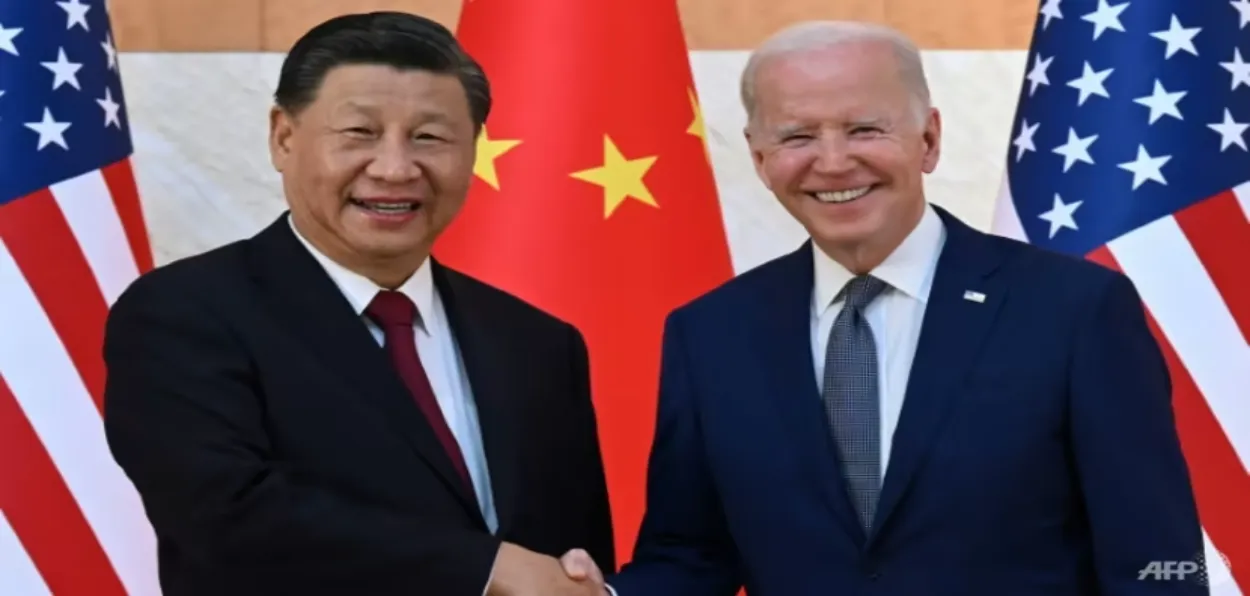

On the plus side, leaders of both the U.S. and China have so far not only shown restraint but sought to bring down the level of stress in the relationship. In the interest of global harmony, it must be hoped that such maturity will continue to be shown in the coming days.

The writer is a senior journalist and commentrator on economy and financial issues