Mumbai

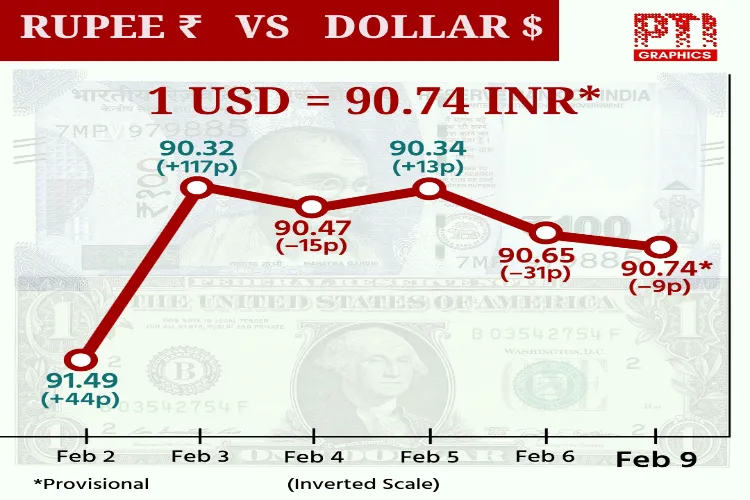

The rupee ended Monday’s volatile session marginally weaker, slipping 1 paisa to close at 90.66 against the US dollar, as market participants weighed the implications of the recently announced India-US interim trade framework amid mixed global cues.

Forex dealers said the domestic currency swung sharply during the day, with gains driven by firm equities and foreign fund inflows offset by risk-averse sentiment and importer-led dollar demand.

At the interbank foreign exchange market, the rupee opened unchanged at 90.66 per dollar and strengthened in early trade, rising to an intraday high of 90.37 — a gain of 28 paise over the previous close. However, the momentum faded later in the session, with the currency touching a low of 90.77 before settling at 90.66 at the close.

On Friday, the rupee had weakened by 31 paise to finish at 90.65 against the US currency.

Investor focus remained on the interim trade framework announced by India and the United States over the weekend, under which both countries agreed to lower import duties on several goods to enhance bilateral trade.

As per the agreement, the US will bring down tariffs on Indian exports to 18 per cent from the existing 50 per cent, while India will remove or reduce duties on all US industrial goods and a broad range of agricultural and food products, including tree nuts, soybean oil, red sorghum, dried distillers’ grains, fruits, wine and spirits.

A joint statement also noted that India intends to purchase goods worth USD 500 billion from the US over the next five years, covering energy products, aircraft and parts, technology items, precious metals and coking coal.

“The rupee’s initial strength was capped by a rebound in precious metal prices, which increased dollar demand from importers. Although global risk sentiment has improved following the Indo-US trade announcement, the currency remains vulnerable to ongoing capital outflows as foreign portfolio investors adjust their exposure to Indian assets,” said Dilip Parmar, Research Analyst at HDFC Securities.

Meanwhile, the dollar index, measuring the greenback’s performance against a basket of six major currencies, slipped 0.05 per cent to 97.58.

Brent crude, the international oil benchmark, declined 1.04 per cent to USD 67.34 per barrel in futures trade.

In the domestic equity market, benchmark indices posted strong gains, with the Sensex rising 485.35 points to close at 84,065.75 and the Nifty advancing 173.60 points to 25,867.30.

Foreign Institutional Investors (FIIs) were net buyers in the equity segment, purchasing shares worth Rs 2,254.64 crore on Monday, exchange data showed.

On the macroeconomic front, India’s foreign exchange reserves surged by USD 14.361 billion to a fresh all-time high of USD 723.774 billion for the week ended January 30, according to data released by the Reserve Bank of India on Friday.

READ MORE: Why reviving Ganga-Jamuni culture is the need of the hour

In the preceding week, reserves had risen by USD 8.053 billion to USD 709.413 billion, surpassing the earlier record of USD 704.89 billion logged in September 2024.