Mumbai

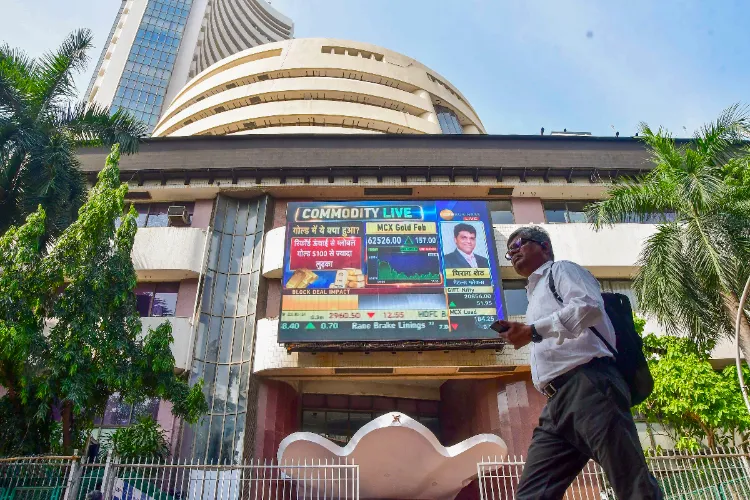

Equity benchmarks Sensex and Nifty ended higher for the third consecutive session on Tuesday, buoyed by firm global cues and easing concerns over tariffs following progress on the India-US trade front, though profit-taking at higher levels capped sharper gains.

The 30-share BSE Sensex advanced 208.17 points, or 0.25 per cent, to close at 84,273.92. During the day, the index climbed as much as 417.20 points, or 0.49 per cent, to touch an intraday high of 84,482.95.

Similarly, the NSE Nifty rose 67.85 points, or 0.26 per cent, to settle at 25,935.15. The benchmark scaled an intraday peak of 25,989.45, up 122.15 points, or 0.47 per cent.

Among Sensex stocks, Eternal, Tata Steel, Mahindra & Mahindra, Power Grid, Tech Mahindra, NTPC, Larsen & Toubro, Tata Consultancy Services, Maruti Suzuki India, Axis Bank, Titan and Hindustan Unilever ended higher.

However, HCL Technologies, Bajaj Finance, Bharti Airtel, Asian Paints, HDFC Bank, UltraTech Cement, Adani Ports and ITC closed in the red.

“Domestic equities maintained their upward momentum, supported by clarity on the US trade agreement and positive cues from major Asian markets. A revival in foreign institutional investor inflows along with appreciation in the rupee further strengthened sentiment, although intermittent profit-booking was visible,” Vinod Nair, Head of Research at Geojit Investments Ltd, said.

Nair added that with tariff-related worries largely subsiding, the near-term direction of the market will depend on third-quarter earnings, which have been mixed and below expectations so far.

“Investors are now tracking how recent fiscal and monetary measures together can help revive earnings momentum in the coming quarters,” he said.

On the broader market front, 2,587 stocks advanced on the BSE, while 1,675 declined and 145 remained unchanged.

The BSE Smallcap Select index gained 0.40 per cent, while the Midcap Select index slipped 0.31 per cent.

Among sectoral indices, auto stocks led the rally, rising 1.35 per cent, followed by consumer discretionary (1.16 per cent), metal (0.83 per cent) and industrials (0.69 per cent). Utilities gained 0.62 per cent, oil and gas rose 0.51 per cent, while focused IT added 0.50 per cent. The IT and telecom indices advanced 0.35 per cent each.

PSU banks, consumer durables, Bankex and the private banks index were among the laggards.

Meanwhile, data showed that equity mutual funds recorded net inflows of ₹24,028 crore in January, marking a 14 per cent decline from the previous month amid cautious investor sentiment due to subdued market conditions and geopolitical uncertainties. This was the second straight month of moderation in inflows.

In the currency market, the rupee recovered from early losses to end 9 paise higher at 90.57 against the US dollar, supported by gains in domestic equities and weakness in the American currency overseas.

“Markets traded in a narrow range on the weekly expiry day but managed to close marginally higher, extending the recent rally. The Nifty opened firm on favourable global cues and moved towards the 26,000 mark, but failed to cross it and largely traded sideways thereafter,” Ajit Mishra, SVP (Research) at Religare Broking Ltd, said.

Sectoral performance remained mixed, with auto, metal and realty stocks outperforming, while pharma, banking and energy shares stayed under pressure, he added.

In Asian markets, Japan’s Nikkei 225, Hong Kong’s Hang Seng, South Korea’s Kospi and China’s Shanghai Composite index closed higher. European markets were mostly trading in the green in mid-session deals, while US equities ended higher on Monday.

Foreign institutional investors bought equities worth ₹2,254.64 crore on Monday, according to exchange data.

Brent crude, the global oil benchmark, slipped 0.20 per cent to USD 68.89 a barrel.

READ MORE: Why did popular vlogger Arbaaz Khan cry over Sanjay Patel's death?

On Monday, the Sensex had jumped 485.35 points to close at 84,065.75, while the Nifty advanced 173.60 points to end at 25,867.30.